Table of Contents

- Mobile First

- Crypto Asset Marketplace Trend

- Benefits of Creating an In-game marketplace

- 1. Mobile game marketplace can help projects to access the appropriate user group

- 2. In-game marketplaces can help to increase user conversion and revenue.

- Bottom Line

- Build your application with Mirror World Smart Platform

Do not index

Do not index

content plan

keyword

keyword list

topic search volume

When talking about Web3 products what will come across your mind in the first place?

The focus often shifts towards prevailing trends such as story-retelling, new technologies, economic models, decentralization, or data attribution. but a key aspect of business, namely revenue, appears to be underlooked.

Most applications are created for the sake of commercial purposes. This is no exception in Web3. Nevertheless, there are limited discussions about how to enhance the revenue generation of Web3 applications.

Mobile First

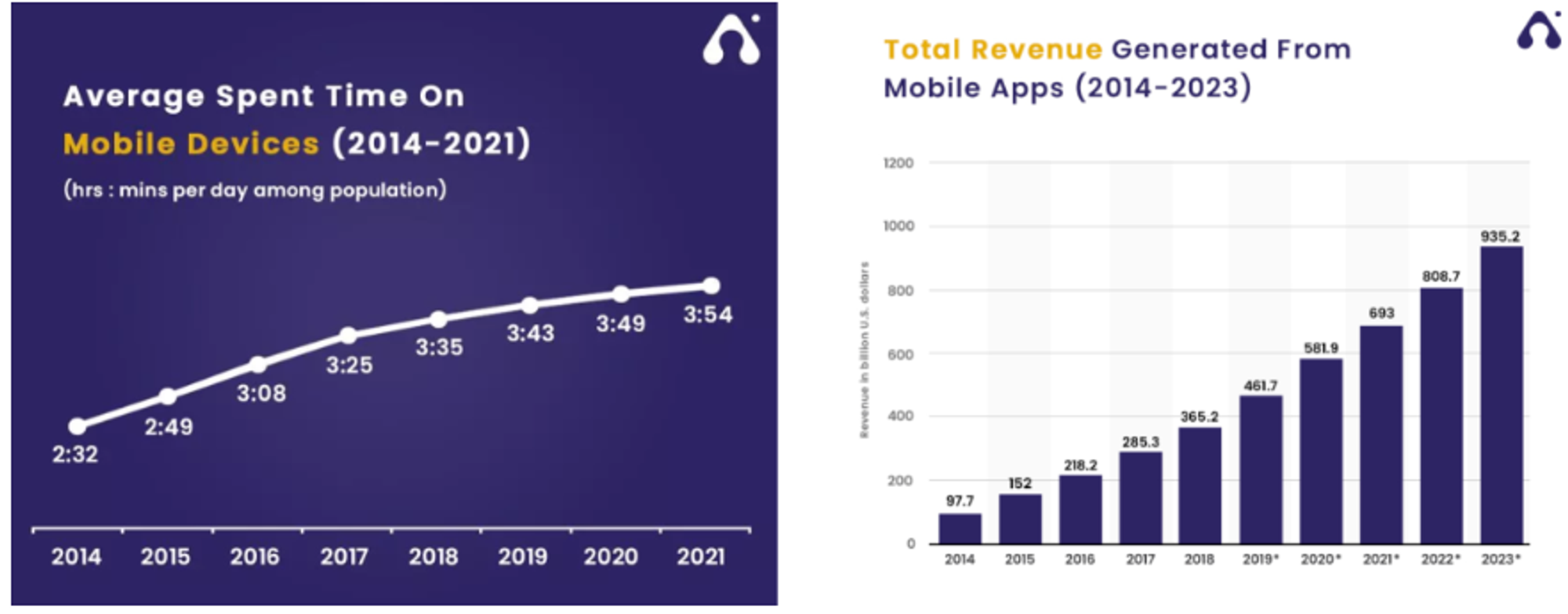

However, the same motif has been answered in the Web2 world. Data shows that the average amount of time users spend on mobile devices each day has been uplifting annually from 2 and a half hours in 2014 to nearly 4 hours in 2021.

Against the backdrop of the economy of attention, revenue is derived from things that users are willing to spend more time on. This is particularly evident in the rapid growth of total revenue generated by mobile apps. Therefore, when developing apps, developers should prioritize mobile platforms.

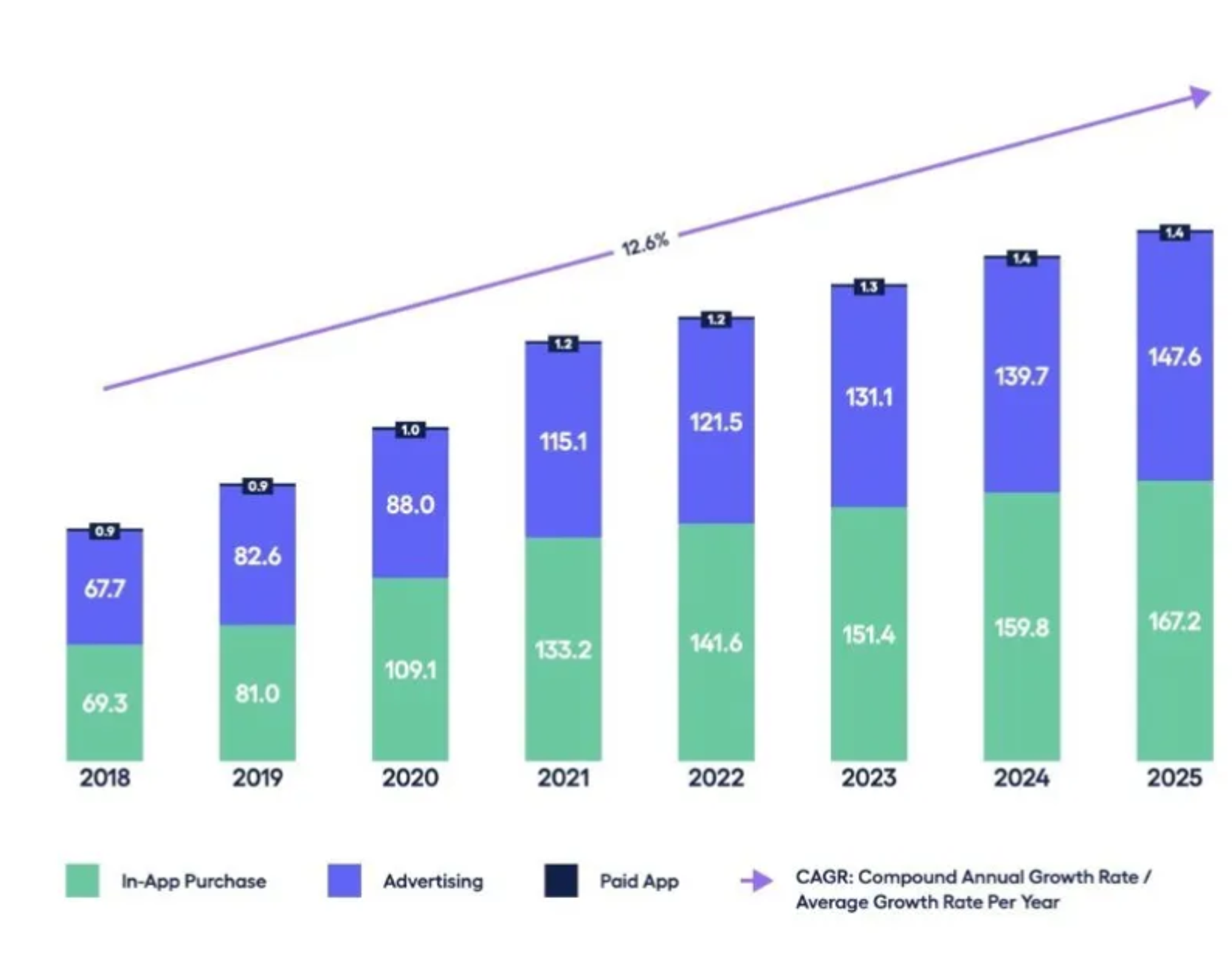

For mobile games, revenue is generated through in-app purchases, in-game ads, and paid downloads. In 2022, in-app purchases accounted for 53.6% of mobile game revenue, and this percentage is expected to continue to rise. The game industry is one of the most maturely commercialized application categories, and is a good example to look at for consistently generating revenue on mobile platforms.

The entire process of acquiring, engaging, retaining, and converting customers has been seamlessly integrated into a single app. While Web2 apps prioritized mobile platforms and in-game marketplaces, developers of crypto game apps have struggled to keep up with the trend.

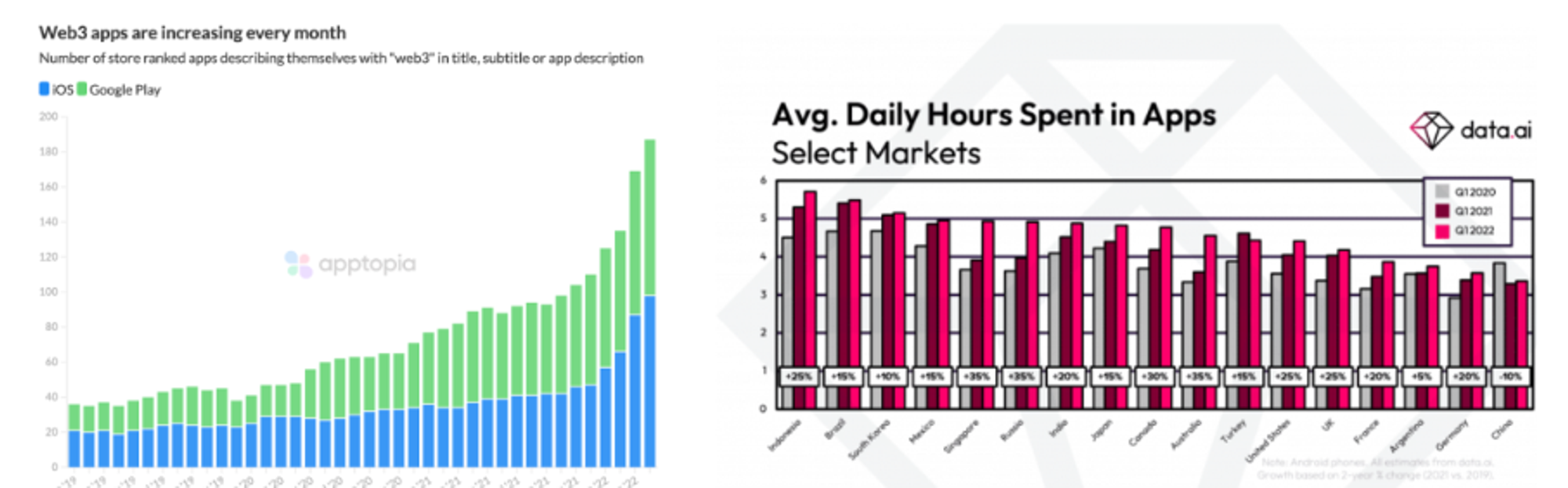

Despite this, it's evident that Web3 apps are starting to recognize the potential of mobile platforms. In 2022, the number of Web3 apps available for download on the Apple Market and Google Store was nearly five times higher than in 2021. Furthermore, the majority of new users of Web3 applications such as games come from Southeast Asia, where the amount of time spent by users on mobile apps is increasing year-over-year.

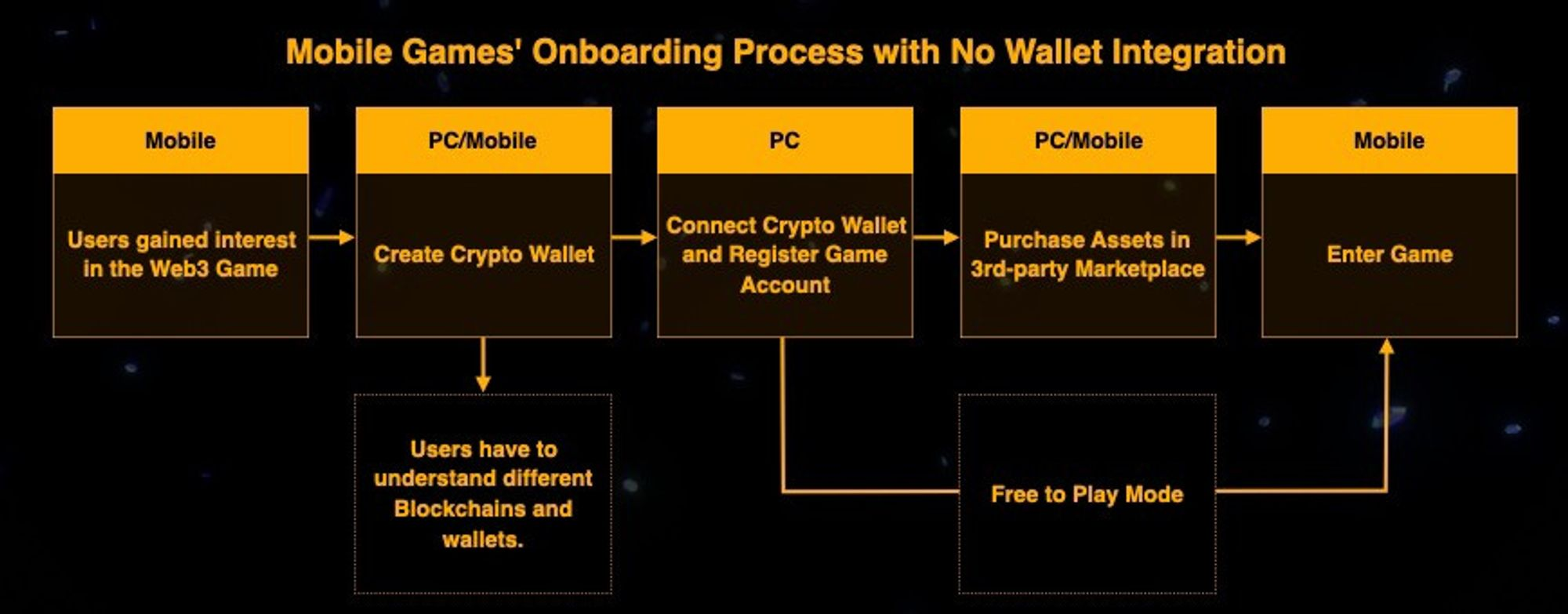

However, the enhancement in the quantity can never offset the issues that occurred in terms of its quality. The status quo for most Web3 applications is that the user experience is often fragmented and disjointed.

Despite the increased availability of Web3 apps on mobile platforms, many apps still struggle to provide a seamless experience for users. This is especially true when it comes to the links between the user and the asset marketplace.

For instance, in Web3 games, users often have to leave the game client and navigate to a separate NFT market to transfer game assets, which can be inconvenient and disruptive to the overall experience.

As such, the corresponding result of this status quo is that

those who play are not willing to buy, and those who buy does not play.

Forcing users to switch interfaces out of mobile crypto apps often results in losing users. Those who purchase in-game items on third-party platforms are typically just speculators. The mismatch between the user base and the poor user experience makes it difficult for current Web3 apps to convert users and generate revenue.

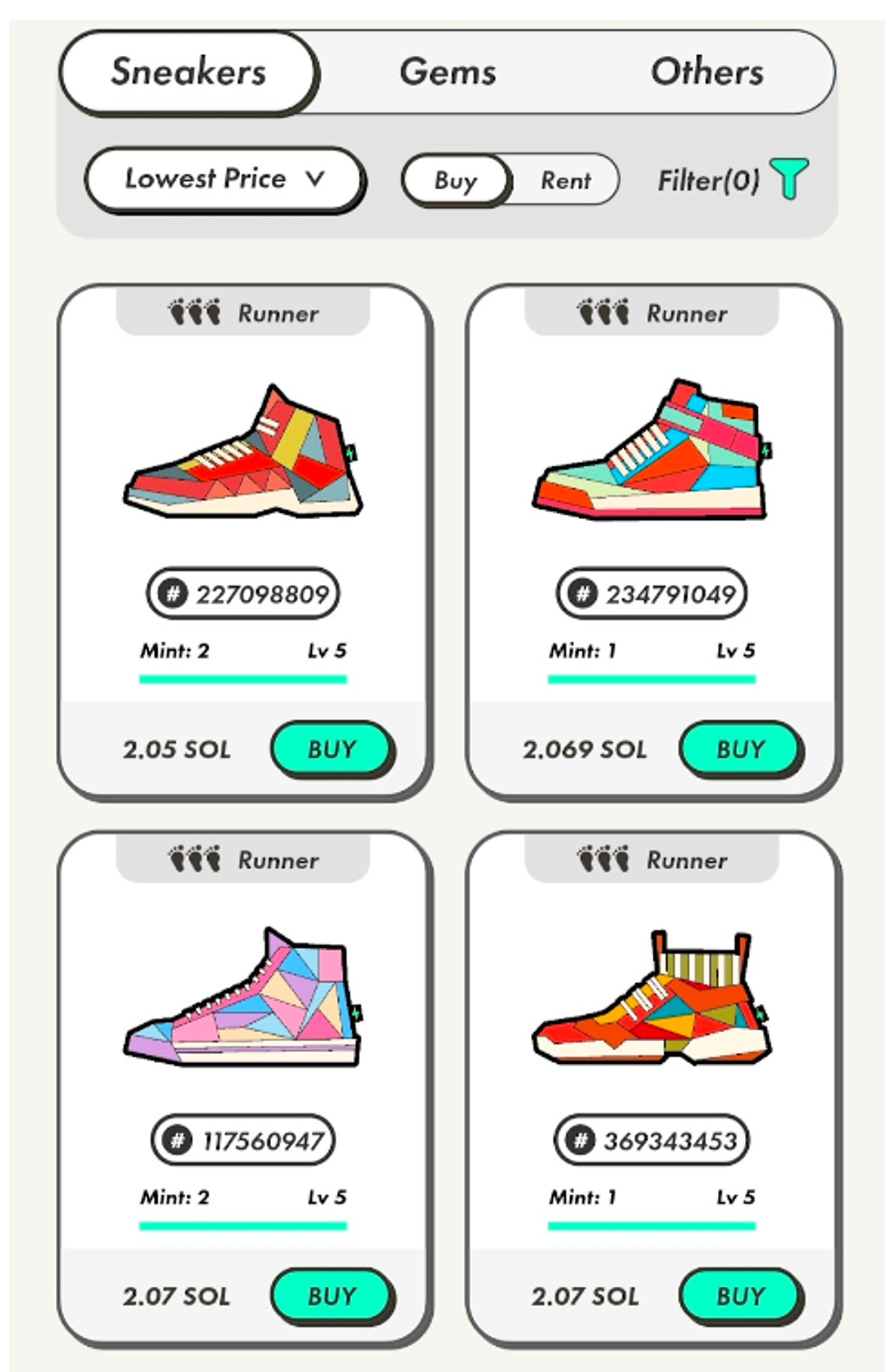

However, StepN, a pioneering Web3 application, has managed to create an in-game marketplace similar to those in Web2 apps. This has helped StepN attract users and establish an initial user base.

The app StepN has implemented closed loop procedures for buying, leasing, and transferring NFTs of sneakers within the app. This creates a continuous experience for users while also avoiding the 30% commission charged by the Apple Store for in-app payments. This feature is attractive to mobile game creators who prioritize user conversions and revenue.

Both StepN and the traditional in-app purchase model of Web2 emphasize the importance of creating a built-in marketplace for applications in order to generate revenue in Web3. However, it is crucial to consider the approach to building this market, the people involved, and the cost-benefit ratio of construction. These factors can greatly impact the success and growth of the industry and individual projects focused on developing Web3 mobile game applications.

Crypto Asset Marketplace Trend

Blockchain game applications inevitably involve the transfer of tokens and NFTs, making a trading market for these assets essential. Currently, the trading market can be categorized into two main types: third-party trading platforms like Opensea and MagicEden where different NFT series are listed for trading, and self-built trading markets embedded within the application itself, like StepN's Marketplace.

To determine which market is more suitable for these applications, factors such as user conversion and revenue creation must be considered. Looking at successful Web2 business models, we can gain insights on this.

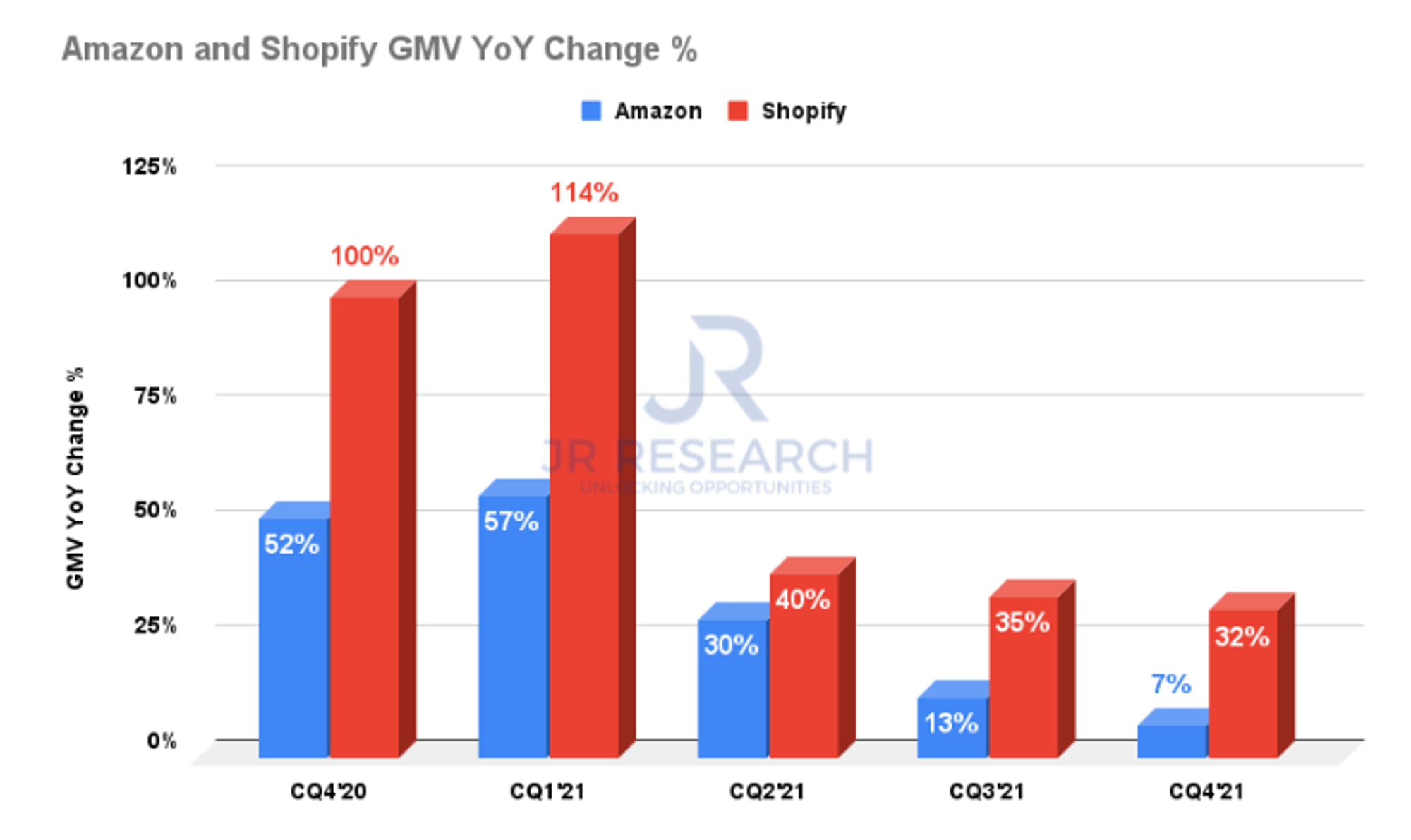

For example, Amazon operates as a third-party trading platform where sellers establish their own stores to buy and sell products. On the other hand, Shopify provides tools and technology to help sellers build their own independent websites and offers various services such as payment, marketing, operations, and customer relationship management.

Quarterly total sales data in recent years reveals that Shopify has a much higher year-on-year growth rate compared to Amazon. This demonstrates that Shopify's customized marketplace model is in high demand in Web2, especially with the growing number of independent e-commerce companies. These companies are capable of acquiring potential customers, building a community, and generating revenue through their own channels.

Similarly, in Web3, projects prioritize community and brand stickiness. A game community can form an independent culture and circle, attracting a large number of fans who spontaneously experience and comment on the product or build for the brand or technology. To manage these dedicated users and increase user conversions and revenue, a customized marketplace for trading is crucial.

Benefits of Creating an In-game marketplace

1. Mobile game marketplace can help projects to access the appropriate user group

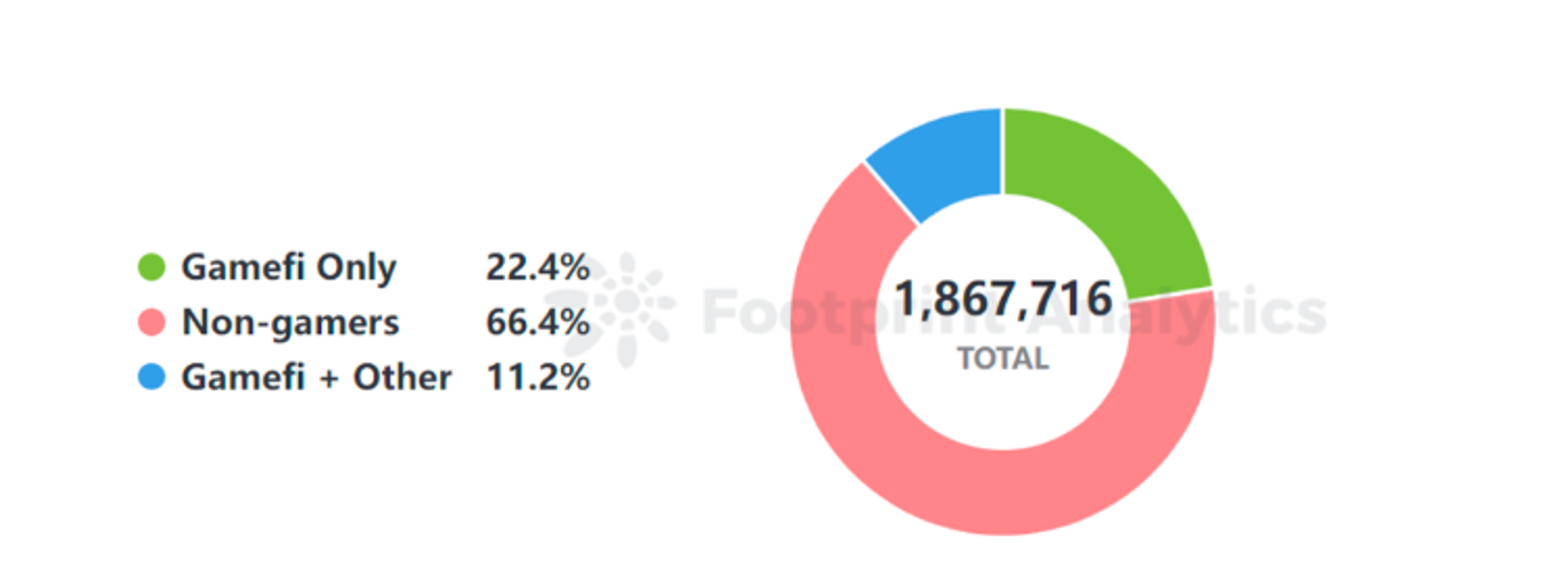

Mobile game apps list crypto assets such as NFTs on third-party platforms like Opensea to serve the application itself. For example, game asset NFTs can be listed on trading platforms to enable users to exchange information through asset trading. This can generate income while enhancing user engagement and encouraging longer adherence to the game.

However, our survey of 315 Web3 games with NFT asset trading capabilities found that almost half of the projects' core transactions did not took place on Opensea. According to Footprint, 66% of all addresses that have traded on Opensea have never traded gaming assets before. Furthermore, only 22% of users are defined as gamers who exchange in-game items, while 11% trade gaming assets along with other categories such as Defi and PFP NFTs. This reality may not be favorable for mobile game projects.

In other words, if a Web3 game's user base consists mostly of traders and speculators, it may negatively affect the game's economy, as those who purchase assets may not actually use them for gameplay. Furthermore, rapid fluctuations in asset prices can also harm users who want to use the assets for entertainment purposes, reducing their willingness to spend time and money in the game.

On the other hand, traditional Web2 mobile games and StepN have their own built-in marketplaces, which can ensure that users who conduct transactions within the app will maintain their willingness to play, leading to increased user activity and revenue generation.

2. In-game marketplaces can help to increase user conversion and revenue.

From the user's perspective, any app follows a closed loop of customer acquisition, activities, retention, conversion, and there will be a churn rate between any of the two steps. If a Web3 application has a poor user experience, it can lose more than 50% of users in these steps, resulting in high customer acquisition costs.

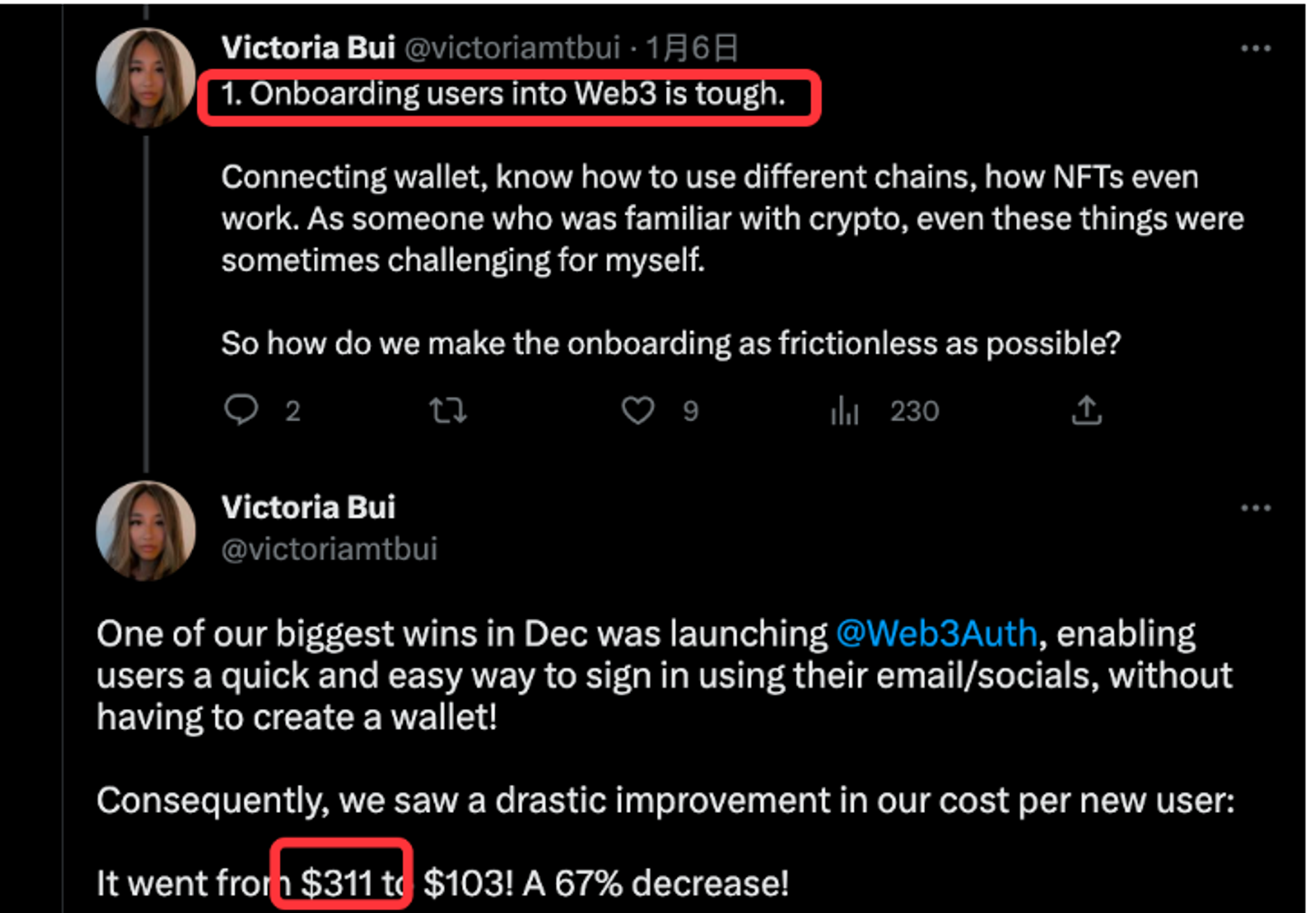

The head of user growth at Decentral Games, a well-known Web3 gaming platform, has publicly stated that the cost of acquiring a single user due to issues such as virtual wallet disconnection can be as high as $311.

Web3 apps face a challenge when users are interested in the content and willing to pay for it, but have to leave the app and go to another website to connect their wallet or link an account to make a purchase. This leads to cumbersome and understanding costs for the user, causing disconnect and distrust that can result in a decline in willingness to pay and application revenue.

In the early days of Axie, the project had an officially established trading market, but it was still independent of the game, resulting in a fragmented user experience. However, with the introduction of the built-in market in StepN, the closed loop procedures can be further refined, ensuring the legitimacy of transactions and providing guarantees that stimulate the sales of primary market assets.

In addition to maintaining the existing form of asset sales, the existence of a secondary market also expands the channels of asset-turnover. Therefore, the project team can consider better integrating game assets such as skins or props into the game content through mechanism design, refining the game experience, generating value, and enhancing the transaction rate.

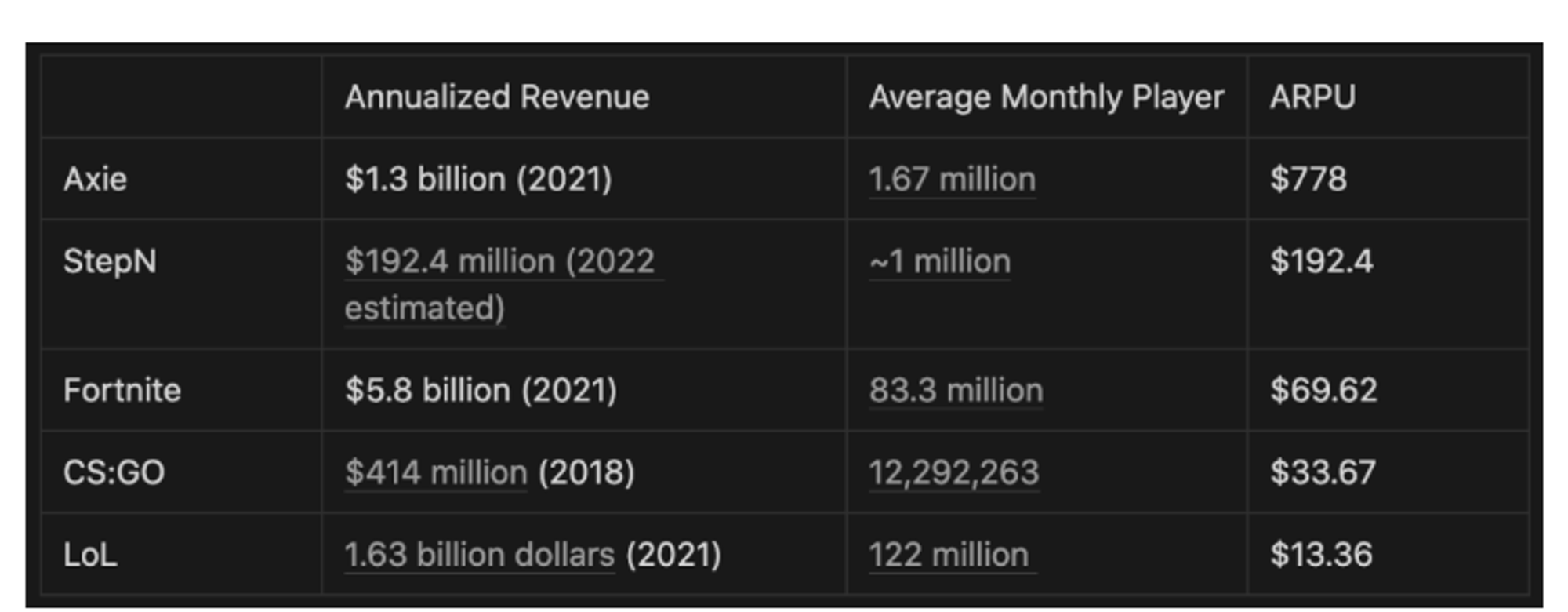

Comparing the revenue of traditional games and cypto games, Axie and StepN, which use marketplaces as their pivotal revenue sources, bear an average revenue of $778 and $192.4 per user, respectively, which is much higher than that of traditional games. If the built-in market brings an increase in user conversion, effectively reducing the average customer acquisition cost of the project, its profit will be even higher.

Most blockchain game studios still rely on third-party marketplaces despite the advantages of self-built marketplaces in terms of user conversion and revenue. However, the cost of using third-party marketplaces, such as Opensea, is high, with a transaction fee rate of 2.5%. A survey found that from September 2020 to the present, over $2 million was paid by dominant Web3 games to relevant platforms.

The reason for this preference for third-party marketplaces lies in the difficulty of developing an in-app crypto asset marketplace. The development process involves multiple channels such as account authentication, wallet services, deposits and withdrawals, and NFT supporting management, each of which requires different technical services from suppliers with varying technical calibers, standards, and connection rhythms.

Bottom Line

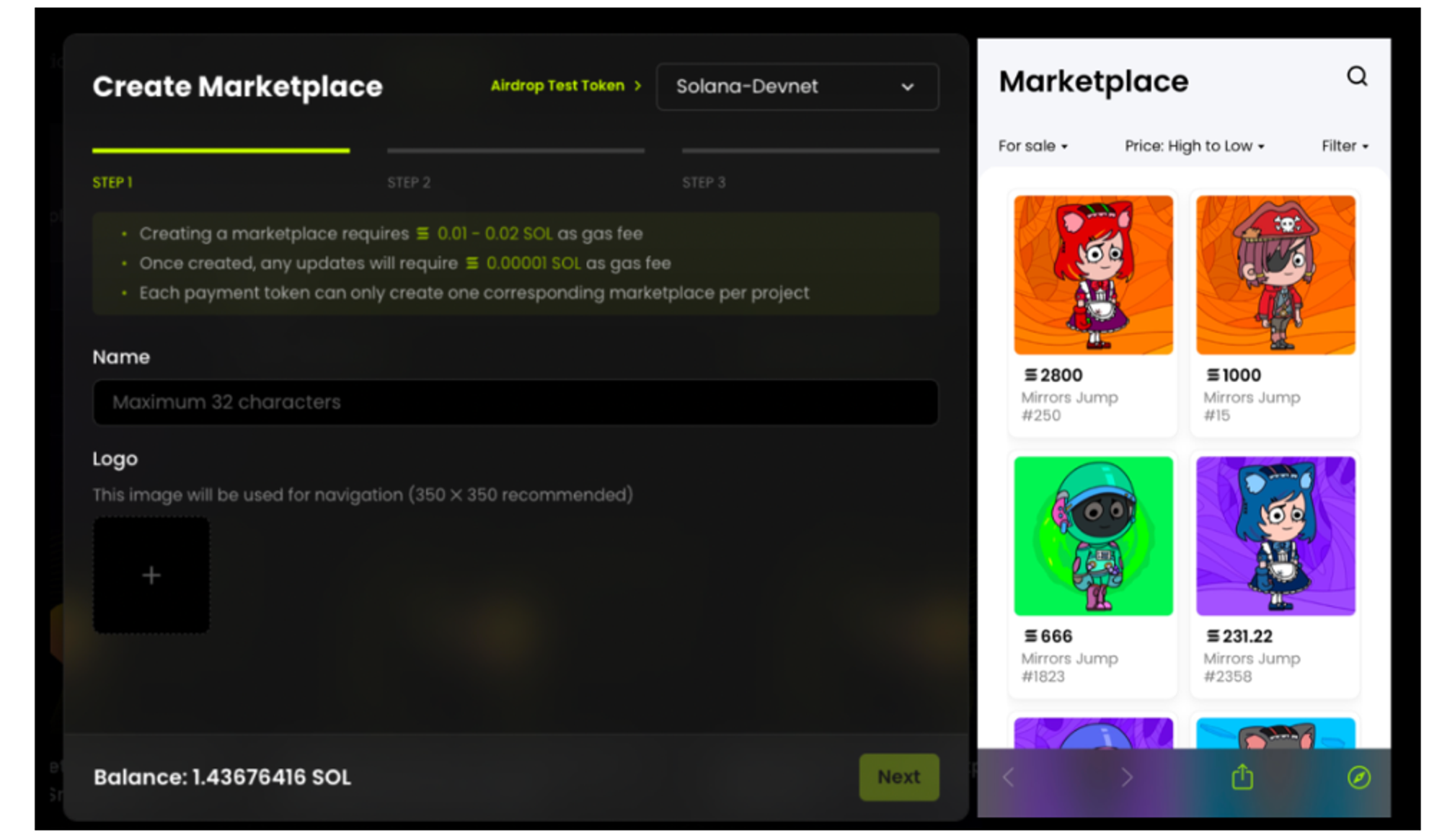

Given the high costs and limited control associated with using third-party marketplaces, it is becoming increasingly clear that building a self-owned marketplace is the way to go for blockchain game creators. Fortunately, with the rise of platforms like Mirror World, building and customizing a crypto marketplace has never been easier.

Not only does owning a marketplace allow for greater control over transactions and revenue, but it also provides an opportunity to create a more cohesive user experience that is tailored to the specific needs of the game. As the blockchain gaming industry continues to grow and evolve, investing in a self-built marketplace will become an increasingly important strategy for staying competitive and maximizing profits. By leveraging the power of platforms like Mirror World, blockchain game creators can take the first step towards achieving greater independence, control, and success in the world of blockchain gaming.

Build your application with Mirror World Smart Platform

Read our full deck here. Mirror World Smart Platform now supports EVM-compatible chains!!!