Table of Contents

Do not index

Do not index

content plan

keyword

keyword list

topic search volume

Life feeds on negative entropy, AI lives to decrease entropy.

The development of blockchain has seen a trend towards rapidly increasing entropy. The emergence of various Layer 1 / Layer 2 ecosystems, accompanied by the growth of different asset categories and various smart contracts or protocols, have brought extreme complexity to the entire blockchain system. In this process, these fundamental complexities further complicate end user experience such as: cross-chain asset settlement, finding and discovering dApp assets across ecosystems, and on-ramping from local currencies to crypto. In essence, these problems point to keywords like “Disorder, Chaos, and Complexity”.

This provides us with an intriguing perspective, that is, to view the development of blockchain system from the angle of thermodynamics and the principle of increasing systemic entropy. This is not a scientific explanation but undeniably an additional perspective to reevaluate the current stage of blockchain development.

We all know that in an isolated / closed system, entropy cannot decrease with time, which means the system trends from order towards disorder. As mentioned before, we observe the exact progression in the system. Without any consumer grade applications, or external system input, such a system will become more isolated, eventually leading to “Heat Death” of the blockchain universe.

Therefore, to introduce more “external system” users as input to combat the increase in entropy, existing participants in the system proposed and developed various tools and services to improve user experience, and to lower barrier to entry for our industry. Yet it is undeniable that these isolated tools further caused the isolation among ecosystems, while introducing cost in shifting through vast information and switching cost between many products.

Since the amount of information and complexity in an emerging ecosystem is high, existing tools have not helped reduce signal-to-noise ratio. Even if users target an ecosystem, they often “miss out” on opportunities without capturing value directly. For example, users often miss out on assets that match their interest or investment preferences but remain unnoticed in the numerous EVM and non-EVM ecosystems. Otherwise when users want to execute a transaction, selecting the best route often wastes too much time, causing users to miss the best time to execute a trade.

However, there exists an increasingly simple solution for this problem. As AI Agents grow and mature, one of their biggest functions is to process and reduce the dimensionality of massive information, helping users capture value. AI’s purpose is to bring rational order to a chaotic system and reduce its entropy.

Mirror World is acutely aware of the necessity of this path. Upon creation of AI Asset Agents, we discover Alpha assets around users’ preferences and gains. Leveraging users’ on-chain transaction data, AI Asset Agents also enable the best routing selection to decrease trading and exchange costs across chains.

AAA identifies the best personalized asset recommendation while helping users settle transactions from any currency, to any asset, on any chain.

We arrived at the above conclusion and vision by participating in distributing and settling asset transactions in the past two years, giving birth to a new product Mirror World will Launch on 12.18, World Store.

1/ World Store’s Logical Brain: AI Asset Agents (AAA)

As mentioned above, the birth of World Store is a direct response to the above issues. World Store will combine the capabilities of AI Asset Agents to effectively solve users' information overload and transaction complexity, providing a more intuitive and efficient asset delivery and transaction experience.

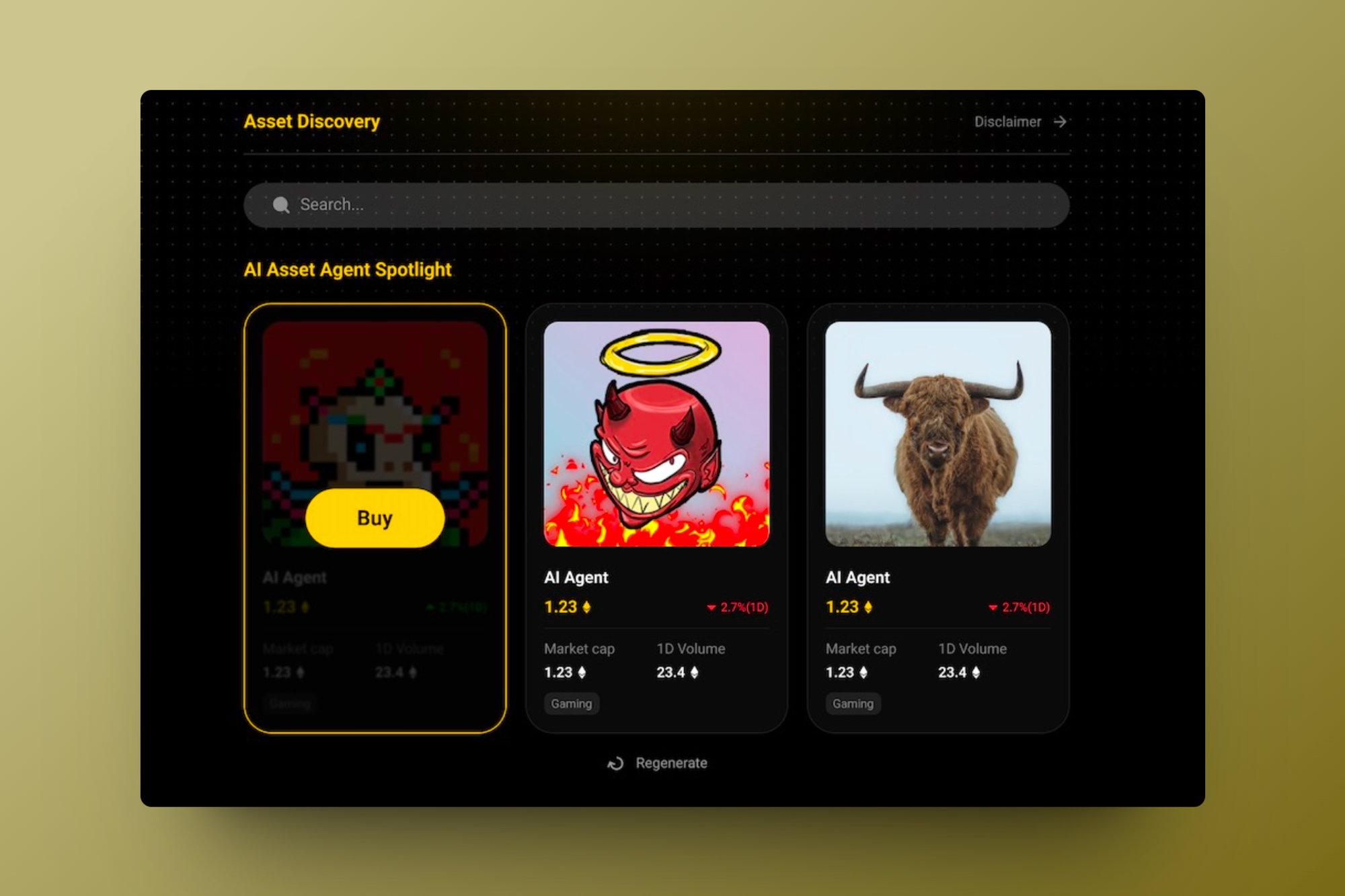

In World Store, users can find various assets recommended according to their interests and preferences and can purchase and settle the assets with their familiar fiat or crypto payment methods.

AI Asset Agents acts as the logical brain of World Store. It uses Natural Language Processing (NLP) and machine learning to understand users' needs and preferences. Based on their on-chain interaction records and asset holdings, AAA recommends related assets and digital content.

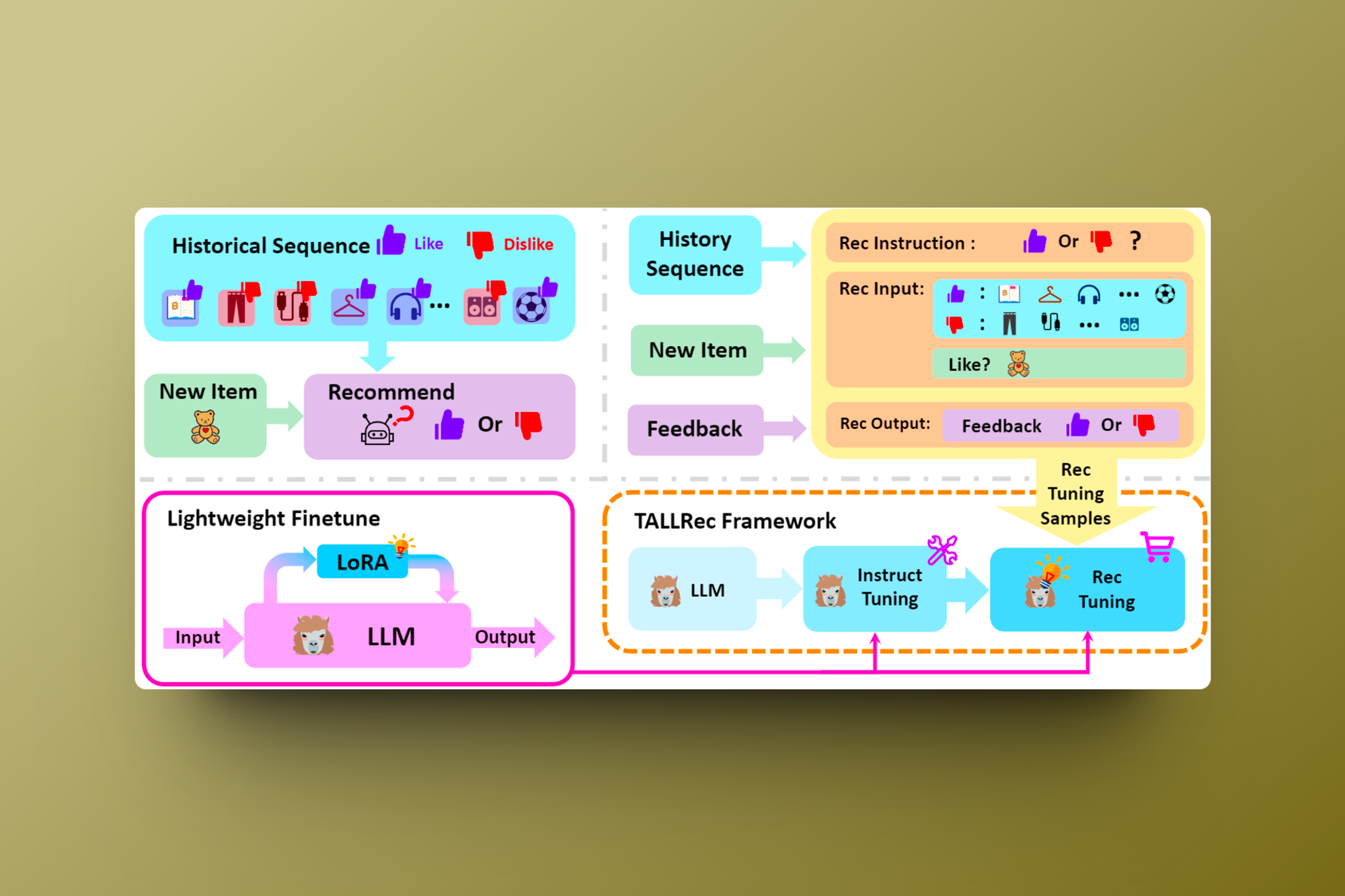

At the same time, AAA combines LLMs to further construct and enrich the implementation of the recommendation system, to achieve specific effects that traditional recommendation systems cannot achieve.

In comparison with traditional recommendation algorithms, LLMs contain rich knowledge mined from massive network corpora, which allows them to supplement the user behavior data that traditional recommendation systems rely on. Traditional algorithms mostly rely on users’ behavioral data, while LLMs can incorporate World (Blockchain World) Knowledge and user interactions for a more complete recommendation. Second, LLMs can adapt to this new domain of knowledge with zero or few-shot learning, allowing them to recommend with limited task-specific data (ie. Wallet Transaction Data) while traditional algorithms often require huge vertical data sets.

Additionally, Large Language Models (LLMs) can be used for various recommendation tasks, such as sequential recommendation, rating prediction, and explanation generation, thereby enabling a unified recommendation framework. In contrast, traditional algorithms typically require building different models for different tasks. LLMs also possess interactive and feedback mechanisms, which can improve the user experience and enhance the explainability of the model. Our AI Asset Agents can gain a deeper understanding of user needs through conversational interactions, even continuously adjusting its recommendation strategies during the interaction. Users can make specific requests or provide feedback through dialogue, and the AI Asset Agents will optimize the recommendation results based on this information.

AI Asset Agents can continually learn from user interactions through machine learning, thereby improving their recommendation algorithms. This means that over time, the recommendation system will become increasingly adapted to the individual preferences of users.

2/ World Store’s Execution Engine: AI Asset Center

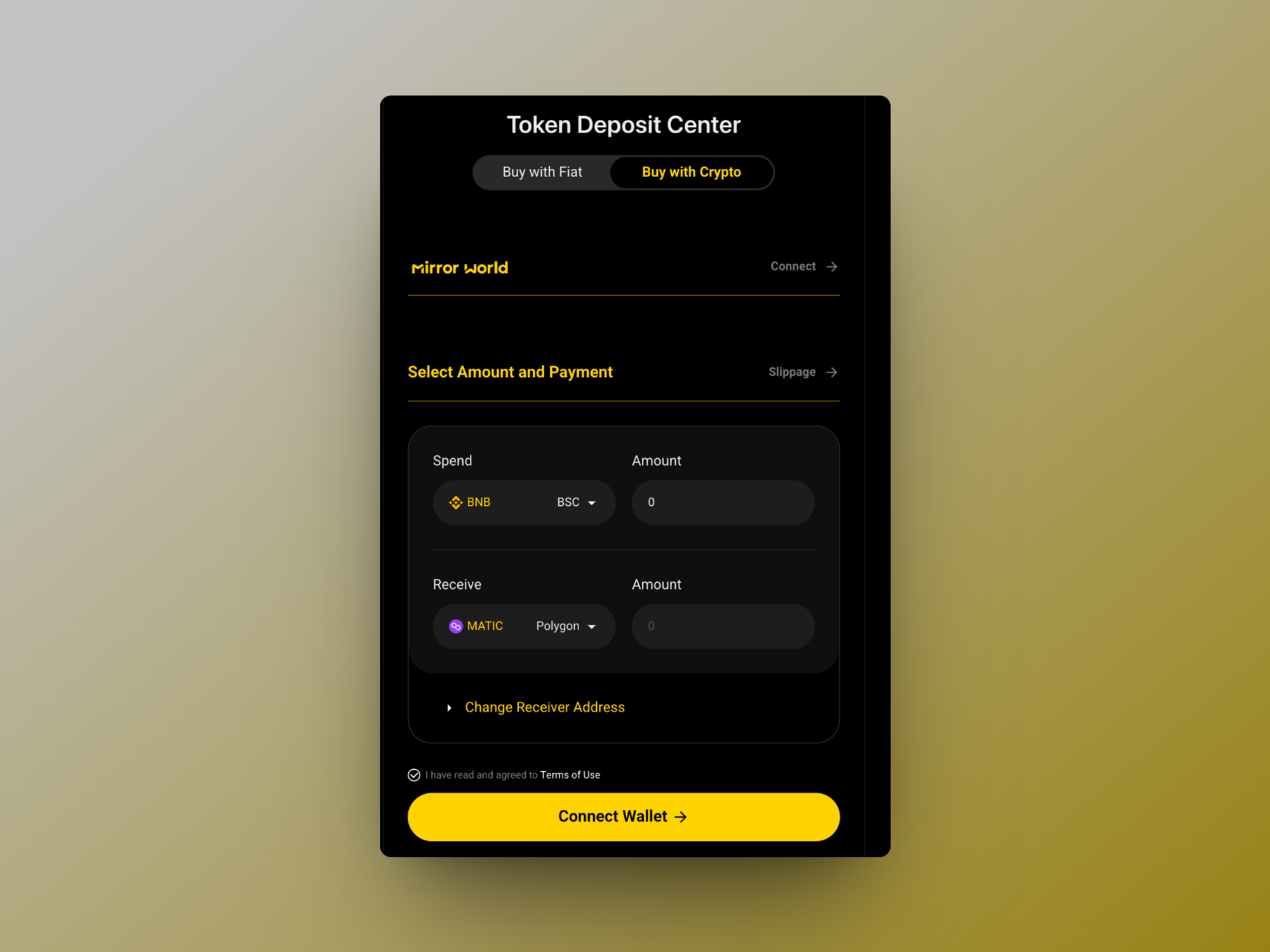

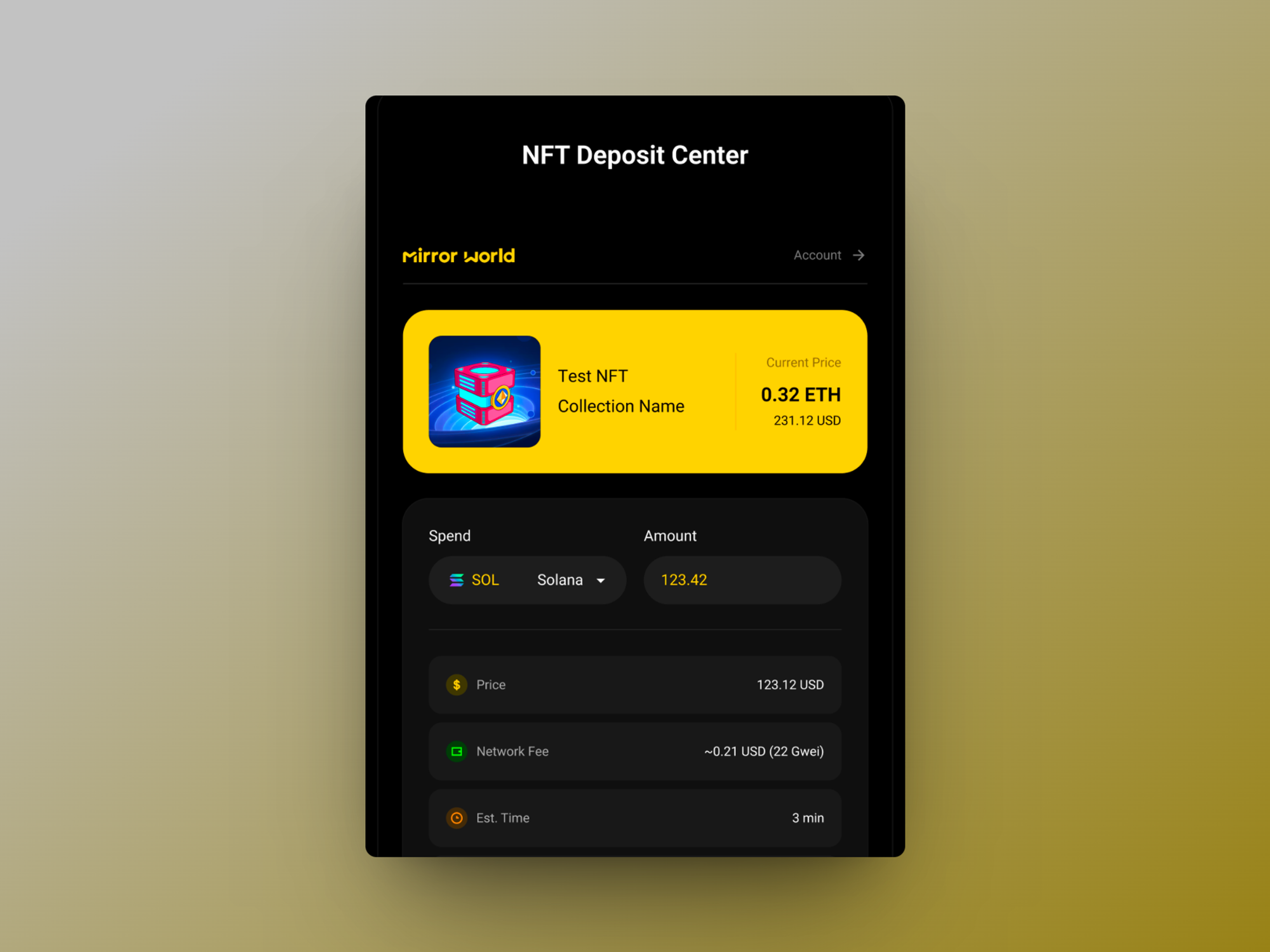

When executing asset trades and settlement, World Store integrates various on-ramp providers, cross-chain DEXs, to provide a unified payment and deposit center: World Store. Users can complete all payment and settlement operations within World Store. During these operations, the AI Asset Agents recommends the most efficient execution route based on user choices, thereby reducing complexity of user interaction and the execution costs involved in the transaction process.

Currently, World Store supports fiat payment channels in 150+ countries, 50 + local fiat payment methods and 10 + public blockchains. We have also integrated with 20 + public blockchains, 15 bridges and 28 DEX to power token swaps and transfers through any network.

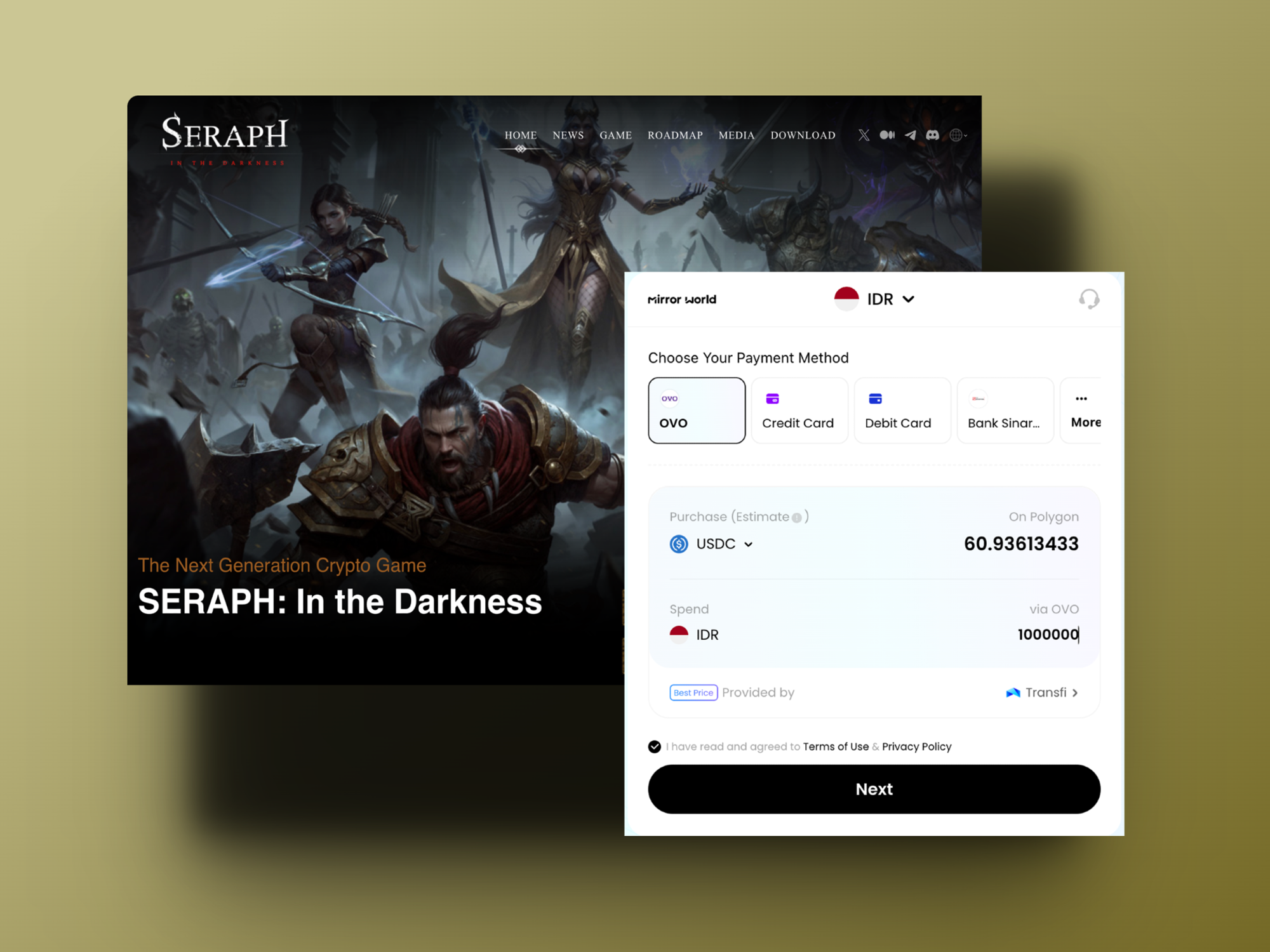

Let's imagine this scenario: Game NFTs are deployed on the Polygon network, and as a user, despite logging into the game via Polygon, the token assets are distributed on other networks. This leads to difficulties in the actual gaming experience due cross-chain operations, making it impossible to directly purchase these game assets within the app. However, it's foreseeable that, after integrating with World Store, users or players can easily use their assets from any network to purchase and settle transactions for game items.

Additionally, as users interact with World Store, their interaction data is further fed into the AI Recommender to enhance the quality of the algorithm's recommendations. As a reward for user asset interaction behaviors and algorithm training, we have introduced Points System to incentivize users from their side.

3/ World Store’s Reward Center: Points System

As mentioned above, to further support users' transaction behaviors and to provide data for algorithm training, we also offer incentive measures for all users who interact with the product. This is to encourage their asset interaction behaviors, and for this reason, we have introduced our Points System.

.png)

With Points System, users can earn potential rewards by trading and depositing through World Store. Similar to a credit card points systems; whenever users make referrals, asset purchases or exchanges, they earn corresponding points. These points can then be redeemed for benefits and rewards distributed by World Store in the future.

In addition to experiencing all these features directly in the asset purchasing process of World Store, Mirror World also offers open APIs and Widget integration services to all application developers. This is aimed at helping more application projects tackle complex asset settlements and commercialization challenges.

.png)

To Conclude

The integration of World Store and AI Asset Agents can bring a whole new interactive experience to more users, lower the barriers to interacting with blockchain assets, enhance the use of these assets, and improve the discovery of high-quality assets, ultimately reducing entropy in the entire blockchain system.

As Large Language Models and blockchains continue to develop and mature, we inevitably board the train of technological acceleration. In an upcoming bull market, this accelerating train will to discover Alpha.

On December 18, 2023, we will release World Store Alpha Version, looking forward to everyone’s participation: https://worldstore.mirrorworld.fun/

Find more information about World Store:

Twitter: https://twitter.com/joinmirrorworld

Discord: https://discord.gg/joinmirrorworld

.png?table=block&id=b0693e91-fb6a-4c07-b4e4-4df81a0b9e42&cache=v2)